Need A Mortgage? Get Qualified Without Just Relying On Your Credit Score

Know before you go! Using the patented Passport Wallet ® system from FormFree ® , instantly know how much of a mortgage you can afford.

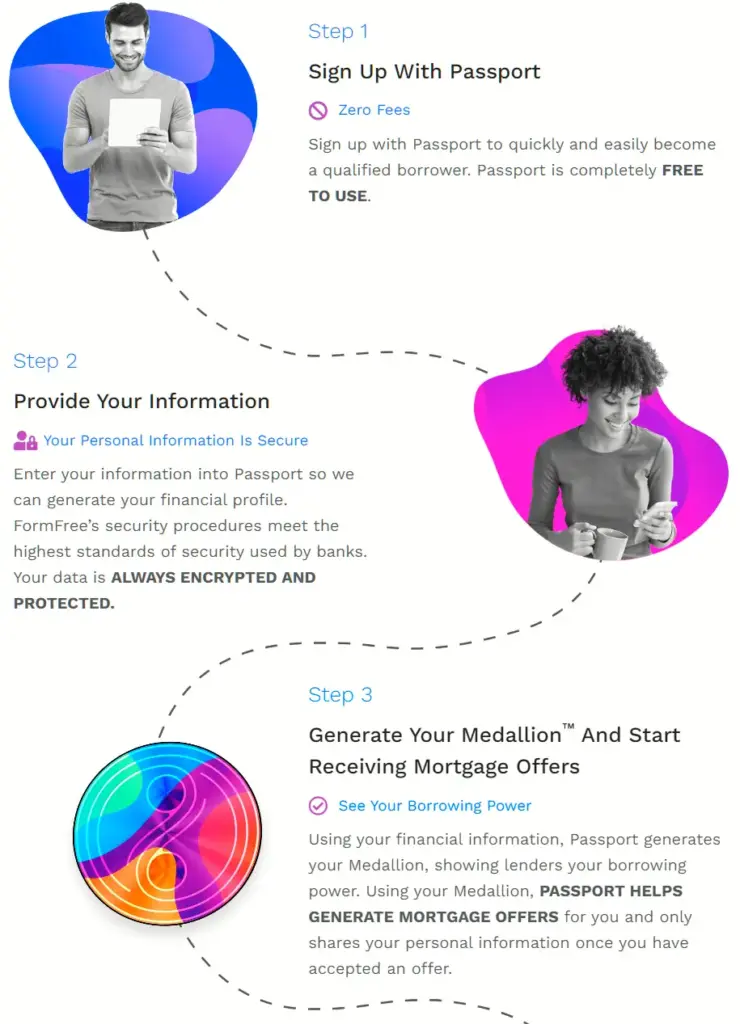

Becoming A Qualified Borrower With Passport Is Simple

*FormFree does not sell your information for marketing campaigns

Sign Up With Passport

Sign up with Passport to quickly and easily become a qualified borrower. Passport is completely FREE TO USE.

Provide Your Information

Enter your information into Passport so we can generate your financial profile. FormFree’s security procedures meet the highest standards of security used by banks. Your data is ALWAYS ENCRYPTED AND PROTECTED.

Generate Your Medallion ™ And Start Receiving Mortgage Offers

Using your financial information, Passport generates your Medallion, showing lenders your borrowing power. Using your Medallion, PASSPORT HELPS GENERATE MORTGAGE OFFERS for you and only shares your personal information once you have accepted an offer.

We Are Here To Fix The Broken Mortgage Industry

After being denied for a mortgage, Kiara used Passport to secure a mortgage and get her dream home.”

“I did everything I could to get a mortgage. I used Passport and got the mortgage I needed to get my dream home.”

of Black Americans have a 659 credit score or lower Hispanic Americans have a 659 credit score or lower Americans have no credit score or a credit score too low to get a mortgage of Black Americans have a 659 credit score or lower Hispanic Americans have a 659 credit score or lower Americans have no credit score or a credit score too low to get a mortgagePassport Removes Human Bias And Creates A Secure Environment

Click “Get Started” to sign up and begin the process. It’s FREE to use.

Using your banking data, we are able to help you determine your ability to pay and borrowing power, generating a RIKI Score.

RIKI stands for Residual Income Know ledge Index, FormFree’s patent-pending measure of Ability-to-Pay (ATP ® ) based on income and spending.

Regardless of your race, gender, age or socioeconomic status, we can determine how much you can afford to borrow based on your income and expenses.

By analyzing your banking data, we provide mortgage lenders with a more complete picture of your financial situation.